1. Volume pools

What is Trading Volume?

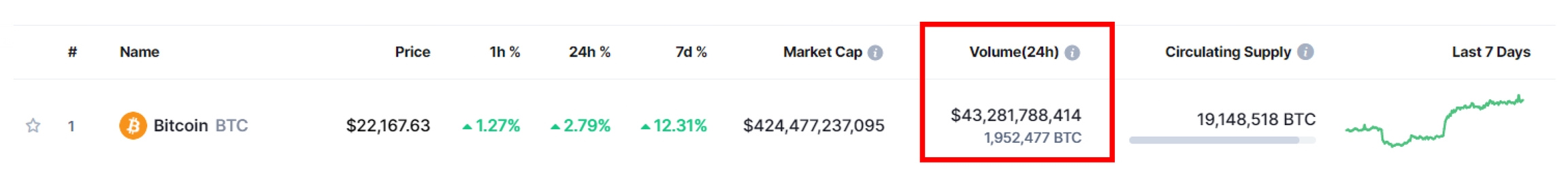

The 24-hour volume, or trading volume, refers to the total quantity of a specific token (or other asset) that is traded within a 24-hour period.

This metric is widely used in token analytics and is available on all trading analytics platforms. Traders often use the volume indicator to gauge the strength of a trend.

Having high levels of volume may indicate low volatility of the price action

Why volume is so important?

For token issuers

Despite its role in trending technical analytics, volume also has significant implications for the future of a token project.

Many exchanges and protocols have requirements for listing new tokens, including a minimum average 24-hour trading volume.

For instance, it is common for top tier exchanges to require a minimum average 24-hour trading volume of 500K to 2MM for a given period of time.

The Volume Marketplace allows projects to generate the extra volume they need to meet these requirements and increase visibility in the trading community in a cost-effective way.

For exchanges

Exchanges compete to attract more volume because they earn fees from each transaction. These fees, which are charged to traders as a percentage, can vary based on factors such as monthly trading volume and the staking of the exchange's native token.

Wash trading, a practice performed by some sophisticated traders, can damage an exchange's reputation by inflating its volume.

The Volume Marketplace helps exchanges to increase their real volume and attract new users, generating trading fees from retail volume and reducing their reliance on market makers.

Other interested parties

A community agreeing to place rewards to increase volume to influence a token's price.

A whale (large token holder) sharing some of their tokens to maintain price stability and prevent price depreciation in a bear market.

Why users should prove their volume through zkMakers?

Traders can generate multiple streams of revenue and contribute value to the crypto ecosystem privately by certifying their trading activity. By trading actively, you can:

Earn yield from your locked assets on exchanges by certifying your trading activity

Make a profit from your trades (the difference between the buy and sell price)

Receive rewards through the dMarket Making Marketplace

Earn APY and govern the zkMakers DAO by staking ZKM tokens, which are distributed as rewards

Support projects by providing volume and liquidity to their orderbooks

What are the costs for Traders or Volume Providers?

While using the zkMakers platform is free, traders may incur gas fees for certifying their trading activity on the blockchain.

What currencies can I add as rewards?

The Smart Contracts accept as rewards:

Whitelisted tokens

Either of the two tokens that are part of the pool pair, as long as they are deployed on BNB chain.

Whitelisted cryptocurrencies and tokens:

USDT

BUSD

BNB

Many traders prefer to receive their rewards in stablecoins or top-tier coins. To encourage the use of whitelisted tokens, we offer a fee reduction when adding them to a pool. Please see the fees section for more information.

Projects and tokens that are not depolyed in BNB chain can also create pools to promote their volume. They can add rewards in Whitelisted tokens.

Reward distribution calculation

Volume reward distribution calculation

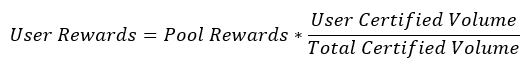

Traders obtain rewards according to the percentage of certified volume with respect to the total certified volume.

Liquidity reward distribution calculation

We will be sharing the information shortly.

Last updated